CNC machining is still going strong within the world of manufacturing, showing precipitous growth even amidst the slew of competing technologies and new entrants. Even so, CNC machining is a wide ocean with many varying interests and trends within it. With so many sub-technologies it can be hard to keep track of what the latest shifts are so here’s our handy guide for the recent developments in 2019.

Market Outlook

The overall CNC machining market is expected to reach USD 100.86 billion by 2025, CAGR of 7.0% from 2019 to 2025. It’s important to note that earlier estimates from 2014 predicted 5.5% during the forecast period 2016 – 2022, far lower than the reality as these years came to pass. The rise in CAGR is attributed to the need for intricate solid parts with defined finishes. Increased operational efficiency among producers of various goods is the main driver.

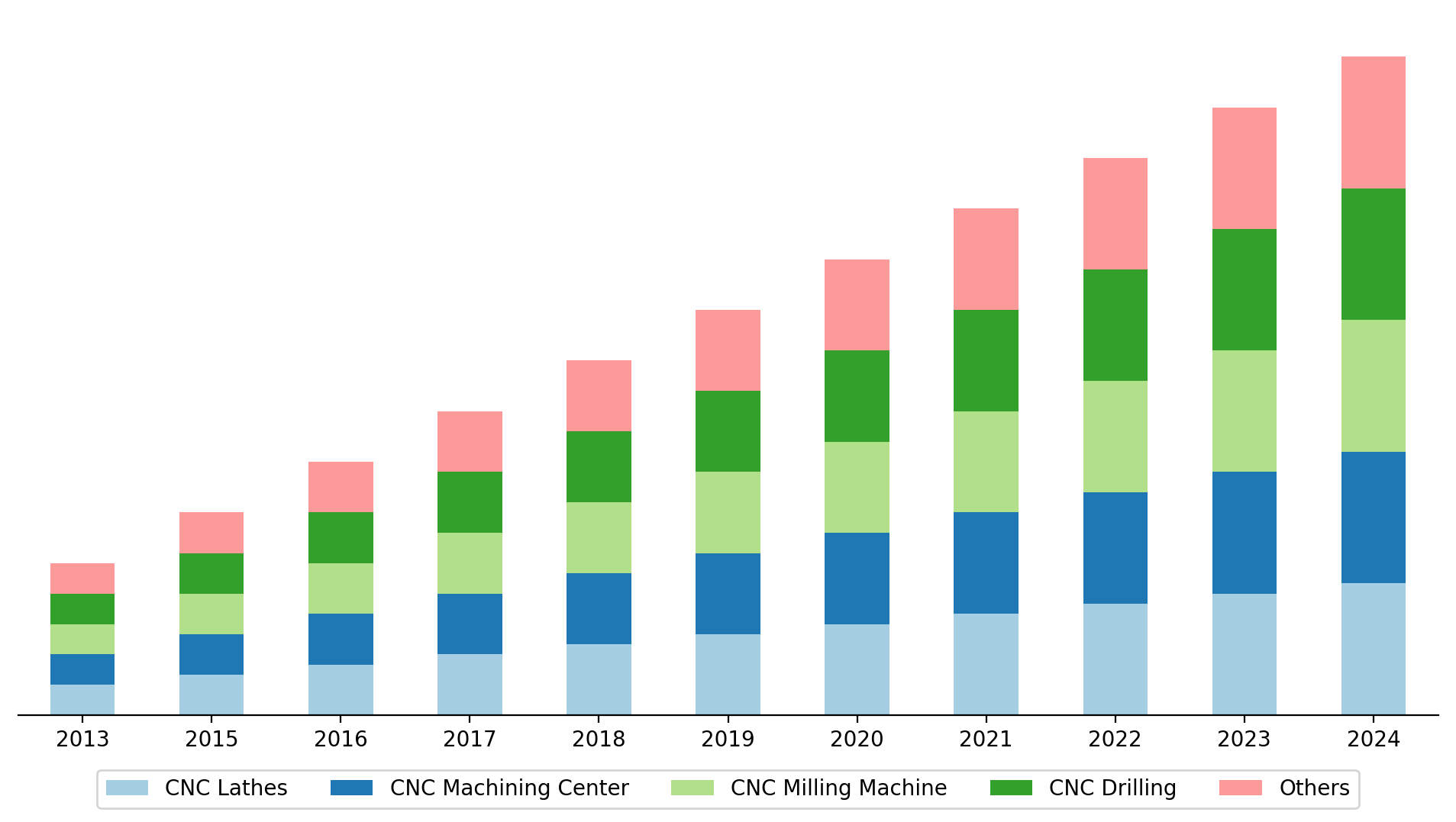

Generally, the market is shifting towards more advanced compact size CNC machines with automatic tool changers and multi axis machining technology. These multi-functional machines are the current hot item among producers. More specifically, the CNC lathe machines segment led the product segment in 2018 and was valued at USD 17.65 billion, while CNC milling machines are expected to be the 2nd biggest market, registering a CAGR of 9.7% over the next six years. Increased adoption of both machines is being attributed to the ease of use they bring in and their diverse capabilities.

CNC milling technologies are also expected to grow, albeit for different reasons than other CNC technologies. The milling machines segment owes its increases to the reduction operational costs it can provide. CNC laser machines are similarly expected to gain traction over the forecast period (2018-2025) as a result of improved machining speed and reduction in the requirement of workforce.

Major Players & Dominant Sub-technologies

The CNC controller market, while highly competitive is also heavily concentrated among 3 companies. With nearly two-thirds of the market being captured by Bosch, Mitsubishi and Siemens, there is a definite sense of these companies as major players. Consequently, the demand side in this market is also very rigid. Suppliers are rarely switched over due to the investment in personnel training and the ability to move applications from one machine to the next.

It is anticipated that the controller market for 5-axis CNC machining is projected to grow at the highest CAGR between 2017 and 2023. Other findings project 6-axis so there is no real consensus. Intense competition in the automotive sector is popularizing the concept of high-precision machines with as little labor input requirements/as much automation as possible.

The data shows increasing interest in Poly Crystalline Diamond (PCD) tools and solid carbide tools over the course of the past few years. This change is due to the need for more durability, resistance to temperatures and fewer vibrations/clatter. There is also a trend towards smaller machines but also with more capabilities. This is in response to the need for less floor space consumption and the growth of factories and shops with diverse needs.

Industries and Users

The highest rate of growth is expected to come from the automotive sector, expanding at the highest CAGR of 9.7%. Aerospace is another major area of growth that has attained revenues on par with the automotive sector. Growth in multiple sectors is expected. This includes medical, pharmaceutical, food processing, government, aerospace, electronics, telecommunications, packaging, general manufacturing and more.

Users of CNC machines are looking for devices with diverse functionalities. They are using CNC lathes to perform cutting, drilling, knurling, deformation, facing, and turning operations, among others. Similarly, the Increase can also be attributed to the rise of improved techniques such as Computer Aided Design (CAD) and Computer Aided Manufacturing (CAM), enhanced capabilities of manufacturers to offer high precision parts and components, and increase in use of CNC machines in various applications owing to their reduction in costs, mass production of products, and high performance. These all drive the growth of the CNC market.

Increasing demand from the automotive, industrial, and power & energy sectors is anticipated to fuel additional growth in the industry. This compounded by the growth of mass production of workpieces, from the automobile manufacturers, at minimal time and expenses, which is pushing up the machine requirements for mills and lathes.

Regional Trends

Due to increased adoption in India, China, Japan and other nations in the region, Asia Pacific is leading the charge. Another factor is that major manufacturers such as Okuma Corporation, Yamazaki Mazak Corporation, and DMG Mori Co., Ltd. are all based in these countries. As a result, Asia Pacific is probably going to remain a lucrative market, and is poised to remain a leader over the next six years. A large factor that contributes to this growth is government initiatives and investment keeping the market competitive. Asia Pacific stands at USD 22.33 billion in 2018 and is expected to grow further.

Europe is also expected to grow as it is considered a major market for advanced technologies. Current roadblocks to beating Asia Pacific in this regard are high barriers of entry and lower investment in the market. On the other hand, the US market is currently saturated with machines. One of the growth areas within the US has been that of the energy sector, attributing to high demands for alternative new energy sources due to fears of obsolescence of the conventional energy systems. That said, the US is definitely the highest ranking in terms of global Multi-tasking machine tools market. Growing use of multi-tasking machines in the aerospace industry and high labor cost are the main contributors to this trend.